Our Saxo Bank Forex Broker Review will highlight a few of the benefits of this forex broker. These include a low minimum deposit, effective research material, multiple deposit options, and free market analysis. This review will highlight the positive and negative aspects of this broker, and help you choose which one to sign up with. Read on to find out which features make this broker stand out in our opinion. Saxo Bank also offers several educational resources, including webinars and podcasts on various topics.

High minimum deposit

The high minimum deposit requirement for Saxo Bank’s retail trading accounts may put many people off. With the company’s high minimum deposit requirement, retail investors may not be able to make a substantial deposit, but that doesn’t mean that the company doesn’t have something good to offer. Saxo Bank is a global broker and follows strict legal guidelines across 15 jurisdictions. It is a member of the Danish Guarantee Fund for Depositors and Investors and provides services that conform to the Markets in Financial Instruments Directive. Saxo Bank withdraws funds only to verified bank cards; payments made to unverified cards will be returned. It also doesn’t offer e-wallet services, so withdrawals to credit/debit cards can take up to 10 days.

Saxo Bank offers three different types of accounts. Classic, VIP, and Platinum accounts are available. The entry-level classic account requires a deposit of $10,000. The bank does not charge trading commissions, but it does charge 0.5 pips for volume-based pricing. This is still a relatively low commission if you’re an active trader. You can also opt for the VIP or platinum account, which require deposits of up to PS200,000.

Low spreads

Saxo Bank is a leading brokerage company offering a range of services to traders. This company also offers a highly detailed platform, a large range of products, and customer support in several languages. However, some of its features can be disappointing to some investors. Its funding requirements are high – a minimum of $2,000 is required for initial trading. On top of that, there are also high trading and financing fees.

To open an account, you will need to submit a government-issued ID (driver’s license, passport, national identity card, or passport) and verify your residency. You can do this by providing a utility bill or bank statement that proves your residency. Saxo Bank requires a deposit minimum of $10,000 to open an account, so you will need to have some money available to deposit.

Multiple deposit options

When it comes to the minimum deposit requirements at Saxo Bank, it’s hard to beat their user-friendly interface and multiple deposit options. The bank offers three account types, starting with the entry-level Classic account, which requires a minimum deposit of USD 10,000. For those who cannot afford to deposit such an amount, there is a VIP account that offers better prices or you can go to IG Forex Review. For individuals residing in the United Kingdom or Singapore, a Classic account requires a minimum deposit of SGD 3,000.

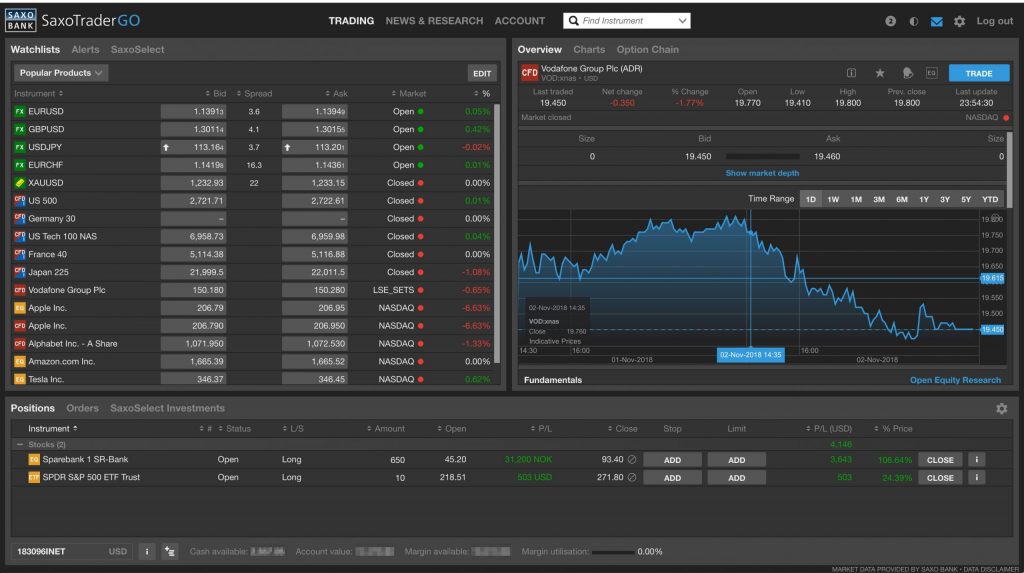

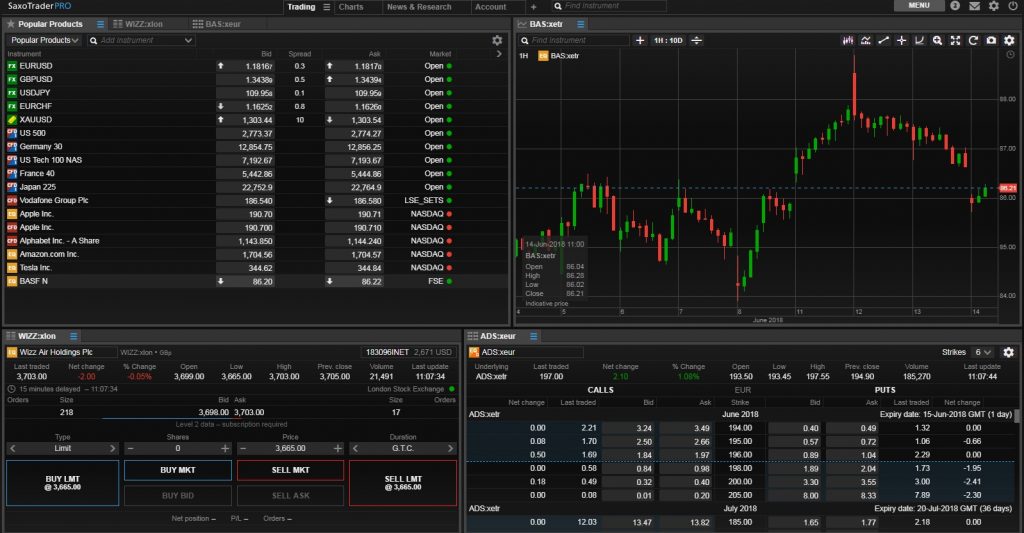

Whether you’re a beginner or a seasoned trader, you can find the perfect trading platform for your needs at Saxo Bank. Traders can choose from over 4,000 assets, including government and corporate bonds. Spreads are typically 0.4 pips, with average spreads of 0.6 pips. The commissions charged are minimal, starting at $3 for US shares. Investors can benefit from numerous research tools, including technical indicators, and use of automated trading systems.

Free market analysis

The free market analysis service offered by Saxo Bank is not intended to provide advice or recommendations for buying or selling a currency pair. The site contains no endorsement or recommendation from the Saxo Bank Group and does not provide an incentive to subscribe to, sell, or purchase a particular product or service. It also does not bear responsibility for any loss incurred by investors. While the free market analysis service is a great way to improve your trading skills and learn about currency markets, there are some cons to it.

While its research is extensive, the lack of trader education and other tools are some of its biggest downfalls. Traders Union experts reviewed the fees and conditions offered by Saxo Bank. There are no fees for withdrawals from an account with https://usforexbrokers.com/reviews/saxo-bank/, but the bank will charge $50 per lot for every $1 million traded. However, it should be noted that the spreads charged by SaxoBank are contradictory. The hidden costs such as carry costs, interest rates, and markups can quickly empty a bank account.

Dedicated support

The Saxo Bank Forex Broker is a European-based company. The company has offices around the world and is regulated by the UK Financial Conduct Authority and the Danish Financial Supervisory Authority. Its products and services include trading in more than 40 asset classes, leveraging cash positions in one account while holding a cash position in another. The bank also offers dedicated support to its White Label clients. Its award-winning platforms serve as the backbone of its offering, supported by a diverse range of value-adding tools.

For white label customers, dedicated operations teams help with onboarding and project management. They handle all aspects of setting up a White Label, including branding and customising trading platforms. The teams also assist with stock transfers and corporate actions. These experts are available around the clock to assist you with your requirements and questions. Saxo also provides live chat support, allowing you to communicate with them through email, phone, and even video.